Rs. 50,000 Urgent Loan: When figuring out your eligibility for a loan, your credit score is one of the most important elements. Nevertheless, the absence of a satisfactory CIBIL rating does not ward you off being eligible for a mortgage in an emergency. Obtaining a $50,000 mortgage in spite of having a bad CIBIL credit score is viable. Those in instant need of Rs. 50,000 can check out plenty of on-the-spot mortgage alternatives, even supposing they don’t have any credit history. Emergency loans, which might be meant to cover unforeseen costs, offer a short investment, typically within two days, without requiring collateral. In this article, we will discuss more about instant loans of Rs. 50,000 to all the eligible members.

Not only are those loans available to people with low credit scores, but additionally, they come with flexible terms for compensation. On the other hand, they often include higher interest quotes and the opportunity of prices; for that reason, prospective debtors should carefully analyze the situations before transferring further. Buddy Loan, PaySense, mPOKKET, Early Salary, Loan Tap, Kredit Bee, Money Tap, SMFG India Credit, Piramal Finance, and Fibe are a number of the reputed lenders that offer pressing private loans. Other lenders that provide those loans consist of Fibe. As a result of the rate with which those lenders cope with and distribute loans, they are perfect answers for individuals who are in acute need of immediate financial assistance.

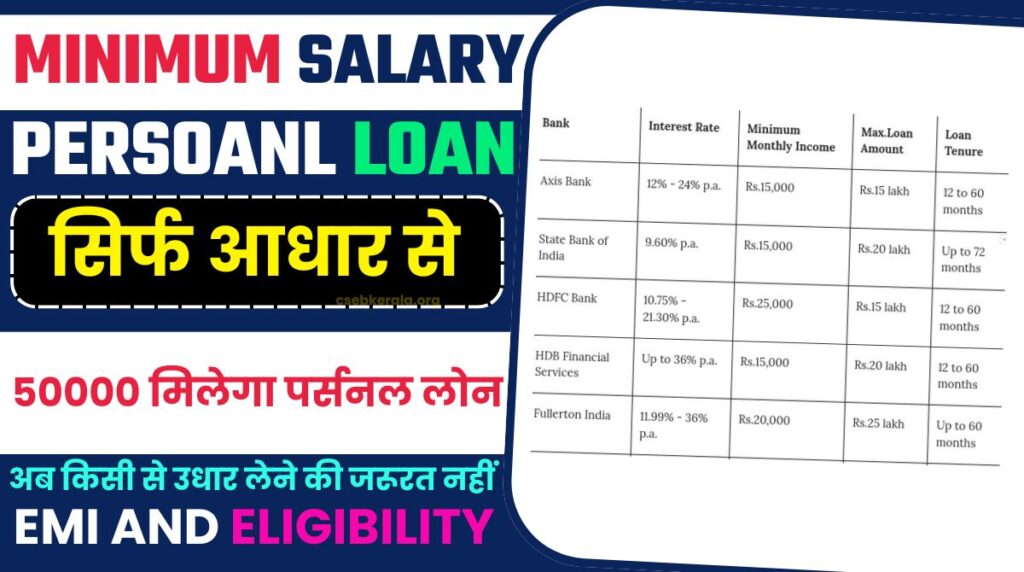

When we talk about the eligibility criteria, you should always note that you must be at least 21 years old and a maximum of 58 years old to apply for an urgent loan with a CIBIL credit score even if it is low or negative score. There are some lenders that offer loans without strict credit criteria, which may prevent them from offering poor loan terms. Micro quick loans typically require very little evidence, such as a driver’s license or Aadhaar card, among other things. By complying with these norms, borrowers are guaranteed to meet the basic requirements set by the lender before they qualify for an instant loan of Rs 50,000. Below is the overview table that you should know.

Rs. 50,000 Urgent Loan – Overview

| Loan Type | Personal Loan |

| Loan Amount | Rs. 50,000 |

| Starting Interest Rate | 11% |

| Processing Fee Rate | 2.5% to 3.5% |

| Enclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs. 350 |

| CIBIL Credit Score | Required |

| Low CIBIL Credit Score | Possible |

| CIBIL Credit Score Range | 300 to 900 |

| CIBIL Credit Score Categories | Poor, Average, Good, and Excellent |

| Personal Loan Application Mode | Online |

| Age Limit (Min) | 21 years |

| Age Limit (Max) | 58 years |

| Check CIBIL Credit Score | Visit CIBIL’s Official Website |

| Official Website (CIBIL) | https://www.cibil.com/ |

As we have already mentioned earlier, you will get an instant loan, especially a personal loan, when you are in urgent need. You will get a personal loan up to Rs. 50,000 at an interest rate of 11% with a processing fee rate charged from 2.5% to 3.5%. You will get your loan instantly only if you are eligible, and one of the major criteria would be that you need to score a high CIBIL credit score of at least 750 or above. But only a few loan lenders allow you to avail of the loan via a scheme. You can easily sit at home comfortably and apply for a loan, as it can be done via any lender’s website or application. If you do not know about your CIBIL credit score, then you can check any lender’s website or CIBIL’s own website, which we have already stated. For more information, you can continue reading this article for a better understanding.

Rs. 50,000 Urgent Loan – Eligibility Criteria

Following are the eligibility criteria that you are required to know in detail to become eligible to apply for a loan urgently:

- You must be a permanent resident of India to be eligible to apply for a loan urgently.

- You must be at least 21 years old and a maximum of 58 years old to become eligible to apply for a loan urgently.

- You must be a working professional or a business magnate to be eligible to apply for it.

- You must be earning at least Rs. 15,000 per month as an individual to be eligible to apply for the same.

Rs. 50,000 Urgent Loan – How to Apply?

Following are the important steps that you are required to know in detail to apply for a personal loan of Rs. 50,000 urgently without any hassle:

- First of all, you must open any internet browser and visit any lender’s website, or else you can open your Google Play Store from your Android phone and search for any lender’s application that will give you instant loans. Let us take the Hero FinCorp personal loan application as an example.

- Then, you need to register the application with your mobile number and email address to proceed further.

- After that, you are required to enter some personal details and other detailed information that is very important.

- Now, you must upload a few scanned copies of documents that are required for verification.

- Next, your application procedure needs to be submitted, and you need to wait for the lender’s approval to get the loan instantly into your respective bank account.

Rs. 50,000 Urgent Loan – Documents Required

While applying for a loan instantly, you are required to submit or upload a few scanned copies of documents mandatorily and these documents include:

- Filled Application Form

- Photo

- Aadhaar Card

- PAN Card

- Passport

- Ration Card

- Salary Slips

- Bank Account Details

- Appointment Letter……..and much more

Rs. 50,000 Urgent Loan – The Bottomline

If you are looking for a personal loan of Rs. 50,000 with a very low CIBIL credit score, then you can follow a few ways to get it, and those include showing you earn sufficiently to pay your EMI bills on time, getting a guarantor or applying with a co-applicant, requesting a reduced loan amount, and checking your credit report for errors. With the help of these ways, you can improve your CIBIL credit score if your score is lower than 800. Personal loans can carry exorbitant interest rates, but they can help you establish credit in the future and get better credit terms.

Frequently Asked Questions – Rs. 50,000 Urgent Loan

Ans: You will get Rs. 50,000 through the lender for a loan.

Ans: The minimum age limit to apply for an urgent loan is 21 years.

Ans: The maximum age limit to apply for an urgent loan is 58 years.

![$1400 Direct Stimulus Check Deposit Date, Eligibility & Check Payment Dates [May-April]](https://csebkerala.org/wp-content/uploads/2024/05/Copy-of-Copy-of-Copy-of-Aadhar.jpg)